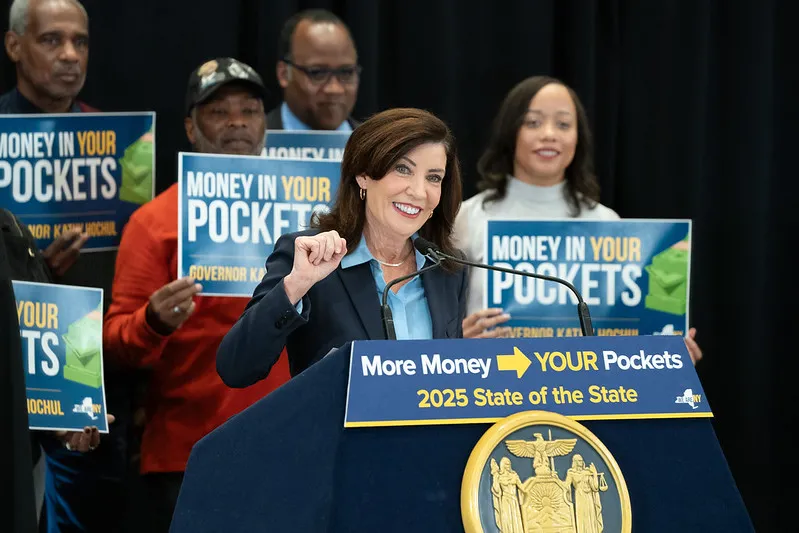

Money in Your Pockets: Governor Hochul Proposes Sending 8.6 Million New Yorkers an Inflation Refund Check

MONEY IN YOUR POCKETS: GOVERNOR HOCHUL PROPOSES SENDING 8.6 MILLION NEW YORKERS AN INFLATION REFUND CHECK AS FIRST PROPOSAL OF 2025 STATE OF THE STATE

Proposal Would Deliver $3 Billion by Taking Excess Sales Tax Revenue Driven by Inflation and Giving That Money Back to Everyday New Yorkers

$500 Payment For Families Making Less Than $300,000; $300 Payment for Individual New York Taxpayers Making Less Than $150,000

Governor Has Delivered More Than $5.5 Billion in Supplemental Payments, Tax Relief and Rebates Since Taking Office

As her first proposal for the 2025 State of the State, Governor Kathy Hochul today proposed New York State’s first-ever Inflation Refund, which would deliver about $3 billion in direct payments to around 8.6 million New York taxpayers statewide in 2025. This new refund would send a payment of $300 to single taxpayers who make up to $150,000 per year, and a payment of $500 for joint tax filers making up to $300,000 per year. Today’s announcement is one of several proposals to help address the cost of living that will be unveiled as part of the Governor’s upcoming State of the State.

“Because of inflation, New York has generated unprecedented revenues through the sales tax — now, we're returning that cash back to middle class families,” Governor Hochul said. “My agenda for the coming year will be laser-focused on putting money back in your pockets, and that starts with proposing Inflation Refund checks of up to $500 to help millions of hard-working New Yorkers. It's simple: the cost of living is still too damn high, and New Yorkers deserve a break.”

Governor Hochul’s proposed Inflation Refund is a one-time, direct payment that will reach New Yorkers throughout every corner of the State, as seen in the following regional breakdown:

| Region | Estimated Recipients |

| New York City | 3,645,000 |

| Long Island | 1,344,000 |

| Hudson Valley | 986,000 |

| Western New York | 620,000 |

| Finger Lakes | 542,000 |

| Capital Region | 502,000 |

| Central New York | 340,000 |

| Southern Tier | 263,000 |

| Mohawk Valley | 208,000 |

| North Country | 163,000 |

| Total | About 8.6 Million |

Governor Hochul is proposing this new Inflation Refund to help address the impacts of inflation on the cost of everyday goods in the years following the COVID pandemic.

In recent years, New York State has experienced growth in sales tax revenues that exceed historical averages. This growth has been driven largely by price inflation. With that in mind, Governor Hochul’s proposal will use that surplus growth to provide a one-time payment to New Yorkers. This payment would be granted to New York State taxpayer filers regardless of homeownership or parental status.

New Yorkers who recently filed tax returns will be eligible for the payment. Taxpayers who are single, head of household, or married filing separately, will be eligible if their income was no greater than $150,000. Resident couples filing jointly will be eligible if their income was no greater than $300,000.

If this proposed Inflation Refund is passed by the State Legislature, payments will be made starting Fall 2025.

NYSUT President Melinda Person said, “Working families across New York know that the current systems are not working for them and NYSUT is glad the Governor is listening to this collective voice. We must seek out solutions that address the ever-increasing gap in income and wealth between the super-rich and the rest of us, and this proposal is a good first step.”

CSEA President Mary E. Sullivan said, “This tax rebate is welcome news for CSEA members struggling with their finances. CSEA applauds Governor Hochul for doing the right thing for the working people of New York.”

District Council 37 Director Executive Henry Garrido said, “It is clear from the many conversations with our members that the rising cost of living remains the greatest challenge facing working New Yorkers. Governor Hochul understands this deeply — and it’s exciting to see her put forth innovative ideas like New York’s first-ever Inflation Refund, which will create new ways to address the impacts of inflation and deliver much-needed financial assistance to New Yorkers. I look forward to working with the Governor to advance this important proposal and I am grateful for her continued focus on the issue of affordability.”

NYS Public Employees Federation President Wayne Spence said, “One thing all New Yorkers can agree on is the cost of living is too high. Governor Hochul’s proposal for a new Inflation Refund represents the kind of thinking we need to help make it easier for New Yorkers to live, work, and raise a family in our state. This initiative would provide a little relief for working families and the public employees of PEF who work so hard to serve them. I’m glad the Governor is taking on this critical issue and look forward to working with her and the Legislature to deliver meaningful support to those who need it most.”

Retail, Wholesale and Department Store Union President Stuart Appelbaum said, “Too many working people struggle to survive in today’s economy and in a world of gross inequality. This announcement will provide necessary financial assistance for many working people across our state, and we fully support it. These hard working New Yorkers worry every day how their families can survive. We applaud Governor Hochul for focusing on their struggles and advocating for their needs.”

United Way of New York City CEO and President Grace Bonillasaid, “Governor Hochul’s proposed inflation refund is a critical step in addressing the affordability crisis impacting so many New Yorkers. As highlighted in our True Cost of Living report, 50 percent of New Yorkers struggle to make ends meet. Rising rents, utility bills, grocery prices and child care costs are pushing families to their breaking point. We witness these challenges every day and this refund is the type of direct investment needed to provide relief. We deeply appreciate the Governor’s leadership and commitment to creating a more equitable and affordable New York for all.”

FPWA CEO Jennifer Jones Austin said, “I applaud Governor Kathy Hochul for leading New York State and the nation, for seeing that like millions of people throughout our country, hard-working New Yorkers are struggling to get by, get ahead and stay ahead, and for doing something about it. The recently released, first-ever national True Cost of Economic Security measure, tells us that what is keeping individuals and families from thriving economically is insufficient resources that haven’t kept up with modern-day, essential costs of living. In moving to increase resources to families in the State through initiatives such as expanded eligibility for child care tax credits, tax relief, tuition assistance and now, inflation refund payments, the Governor is showing leadership and positioning New York to be a model when it comes to providing its residents with the resources they need to secure their economic future, and to live with dignity.”

Governor Hochul’s “Money in Your Pockets” Agenda

This proposal is the latest step in Governor Hochul’s ongoing commitment to help address the cost of living by putting money back in the pockets of New Yorkers statewide.

Since taking office, the Hochul Administration has delivered more than $5.5 billion in supplemental payments, tax relief and rebates, as well as expanding access to child care assistance and paid leave for families and pregnant women.

These past efforts have included:

- More than $4 billion in tax relief for middle-class New Yorkers and homeowners.

- Over $600 million in extra payments for families receiving New York’s child tax credit and the Earned Income tax credit

- Expanded eligibility of New York’s child tax credit to cover kids under 4 years old.

- More access to child care assistance, with eligible families paying less than $15 per week.

- Nearly $600 million in gas tax relief for everyday New Yorkers.

- More than $200 million in additional food assistance for low-income kids.

- Expansion of New York’s Tuition Assistance Program to make education more affordable.

- The nation’s first-ever paid prenatal leave law, so pregnant workers don’t have to choose between a paycheck and a checkup.

- Expansion of New York’s paid family leave program to cover more workers statewide.